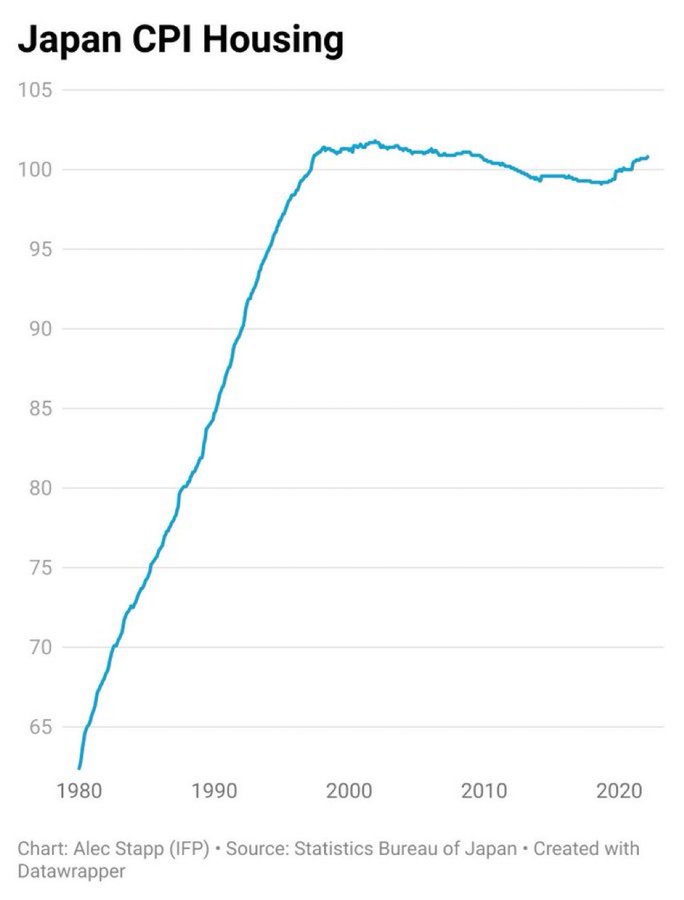

Cost of Housing in Japan Has Not Increased in 25 Years (CPI Data)

The Japanese housing CPI, which tracks rents, utilities, furnishings and other housing expenses, has stayed nearly flat since 1998. This stagnation contrasts sharply with many other developed countries that have seen housing costs surge over the past decades.

Experts cite Japan’s economic malaise and demographic decline as the primary reasons for flatlining and affordable housing prices. An aging population with minimal immigration has suppressed housing demand. Stringent zoning laws have also constrained supply in major cities like Tokyo.

While stable housing costs have benefited renters, the lack of appreciation has been a disappointment for homeowners. Japanese properties saw rapid gains in the 1980s, but have been poor investments since the 1990s. Real estate analysts do not expect major price jumps in the foreseeable future.

Check Out These Akiya Deals:

Consumer prices broadly have also been muted in Japan, rising just 2.5% in 2022. However, costs for other necessities like food and fuel increased more significantly.

The government has implemented economic stimulus policies aimed at generating inflation and growth. But decades of deflationary pressures have proven difficult to overcome. Japan’s central bank is committed to ultra-loose monetary policy until inflation reaches its 2% target.

Cheap Housing For Japanese Residents

The minimal growth in housing costs has helped maintain relatively high affordability for Japanese residents. Tokyo ranked as the most affordable major city in a recent survey by the Urban Reform Institute, owing to inexpensive rents. The average Tokyo resident spends just 15.4% of their income on housing.

By contrast, many US cities are facing dire housing affordability issues. Costs have skyrocketed in prosperous metro areas like San Francisco and New York City. The average US resident now spends around 30% of their income on housing. Studies show over half of renters are cost-burdened, spending more than 30% on rent.

Rapid population and job growth in desirable US cities, coupled with zoning restrictions on new construction, has created a supply-demand imbalance. Bidding wars and all-cash offers have become common, pricing many Americans out of homeownership. Rents are also rising quickly, squeezing lower-income residents.

Home prices and rents did experience a temporary dip during the 2008 financial crisis. But the market rebounded strongly as the economy improved. Japan’s weak macroeconomic conditions prevent such rapid swings.

Affordability may improve in US cities if remote work trends persist post-pandemic. This could reduce demand for expensive city centers. But Japan’s example shows that years of low inflation and minimal growth can forestall major housing appreciation. Its 20-year stagnation provides a lesson for policymakers struggling to control housing costs.

Source: e-stat