Japan’s Youngest Billionaire is Solving the Country’s Biggest Crisis with AI

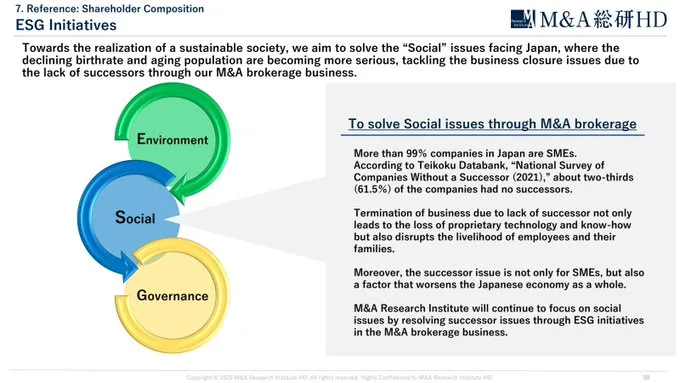

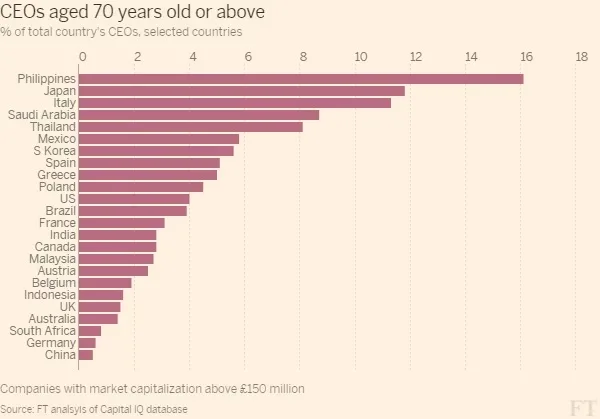

By 2025, 1.3 million Japanese business owners will be over 70 years old with no successor. This could lead to the closure of 620,000 profitable businesses, shrinking Japan’s GDP by $165 billion and eliminating 6.5 million jobs. The youngest billionaire you’ve never heard of is tackling this crisis head-on with AI: Shunsaku Sagami.

A Personal Loss That Sparked a Vision

Shunsaku Sagami’s journey began in Osaka in the 1980s when his grandfather’s thriving real estate agency was forced to shut down due to the lack of a successor. Seeing the company’s license removed from the wall was a defining moment, planting the seed for his future business vision.

From Biology to Billionaire: Sagami’s Unconventional Path

Sagami graduated from Kobe University with a degree in biology and agriculture. An avid Mahjong player, he credits the game for honing his business acumen. Today, at just 33 years old, he is Japan’s youngest billionaire, with a net worth of $1.9 billion.

But his rise was far from straightforward.

The Frustration That Led to Innovation

In 2017, Sagami sold Alpaca, a women’s fashion and cosmetics business. The sale process was frustrating:

- It took over a year to complete.

- Required months of manual research.

- Incurred retainer fees regardless of success.

This inefficiency led him to a game-changing decision.

The Birth of AI-Powered M&A

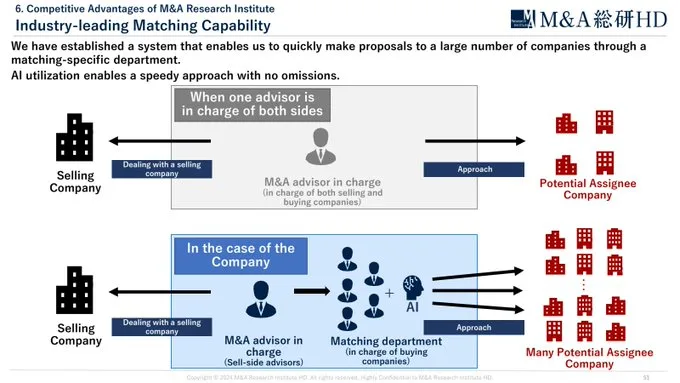

In 2018, Sagami launched the M&A Research Institute, a Tokyo-based M&A brokerage that leverages AI to help aging business owners find successors. His AI-driven approach was inspired by Japan’s automation giant Keyence Corp.

The real breakthrough came when he modernized Japan’s M&A industry with proprietary AI solutions:

- Business matching algorithms

- Automated document analysis for faster due diligence

- Machine learning to match compatible buyers and sellers

How AI is Revolutionizing Japan’s M&A Industry

The impact of Sagami’s AI system was immediate:

- Reduced deal times from 6 months to 49 days

- Eliminated retainer fees, charging only success-based fees of up to 5%

- Streamlined paperwork through in-house digital software

This transformation disrupted traditional M&A practices, making acquisitions faster, cheaper, and more accessible.

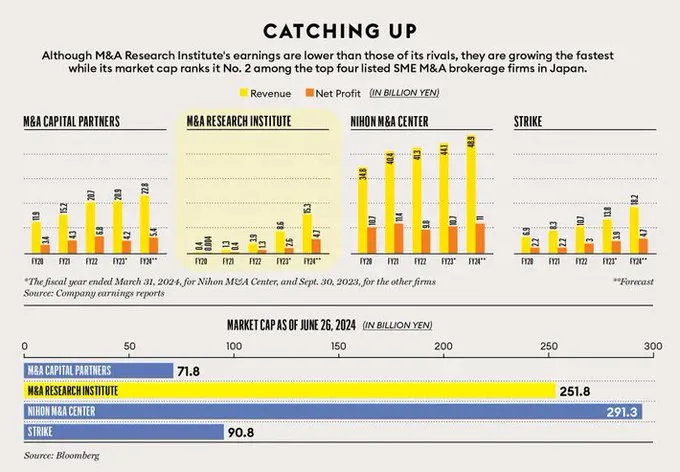

Rapid Growth and Market Dominance

In just the first six months, M&A Research Institute:

- Completed 62 deals worth ¥3.9 billion ($26.5 million)

- Expanded to over 300 employees

- Handled 500 simultaneous deals

- Listed on the Tokyo Stock Exchange in 2022

Today, it is Japan’s go-to M&A solution for small to medium-sized enterprises.

A Billionaire with a Mission

Sagami owns 72% of the company, yet despite his immense wealth, he remains humble:

“I’m not quite sure how I feel about my wealth, but I continue to work hard to create good businesses.”

His next goal? Global expansion.

A Lesson in Problem-Solving

Sagami turned a personal problem into a nationwide solution. His innovation is now tackling Japan’s biggest economic crisis.

As Elon Musk once said:

“You get paid in direct proportion to the difficulty of problems you solve.”

The takeaway? Big solutions often start with small problems.