20 Life-Changing Wealth Building Tips from Robert Kiyosaki

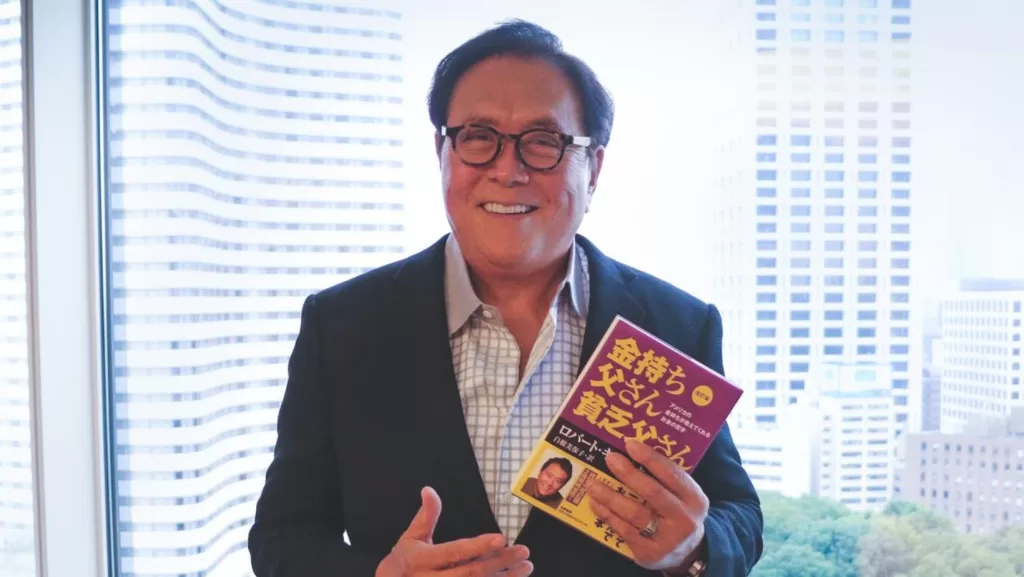

Robert Kiyosaki is the author of the bestselling personal finance book “Rich Dad Poor Dad.” Born and raised in Hawaii to a Japanese-American father, Kiyosaki draws on Asian philosophies about money management. Through parables and advice, his seminal book provides insights on accumulating wealth and achieving financial independence.

With his Japanese-American heritage, Robert Kiyosaki was influenced by Japanese and Asian perspectives on finances and business. Concepts like cash flow and entrepreneurship shaped his money management principles. Kiyosaki credits his Rich Dad’s lessons about money, informed by Japanese financial wisdom, for his success.

1. Pay Yourself First

Always pay yourself first by setting aside a portion of your income for investments and savings. Treat this as a required bill to build your financial security.

2. Think Like a Business Owner

Adopt an entrepreneurial mindset, even as an employee. Seek ways to improve systems and increase revenue rather than just doing your job.

3. Learn About Accounting

Knowing accounting helps you understand cash flow, which is more important than income. Use financial statements to make better money decisions.

4. Acquire Assets

Build wealth by acquiring income-generating assets like real estate, businesses, stocks. Avoid liabilities like credit cards which make you poorer.

5. Take Calculated Risks

Don’t be afraid to take smart risks. Failure is often essential for success. Minimize risk by learning from mentors with a track record.

6. Spend on Investments

Use money to buy assets and investments, not liabilities. Invest in yourself through courses, mentors, and opportunities.

7. Don’t Rely on Job Security

Jobs don’t provide long-term security. Build multiple income streams with passive income from assets.

8. Retire from a Job, Not Work

Love what you do for work. When you “retire,” switch to work you enjoy vs. not working. Retire from a job, not work.

9. Overcome Fear

Fear of losing money prevents wealth-building. Manage risk intelligently but don’t let fear stop you from investing.

10. Choose Mentors Wisely

Seek mentors who are where you want to be financially. Model those who have what you want, not just who talk about it.

11. Make Your Money Work

Don’t work for money – make money work for you through assets that provide passive, residual income. Work on things that grow your money.

12. Continuous Learning

Financial intelligence requires lifelong learning. Read, self-educate, and improve yourself continuously to increase your money aptitude.

13. Own Your Investments

Strive to own the bulk of your investments rather than borrowing to finance them. This increases cash flow and returns.

14. Save Then Invest

First build savings as your safety net. Then invest your savings into assets. Don’t tap savings to invest – invest surplus.

15. Avoid Get Rich Quick Schemes

Wealth takes time and discipline. Avoid gambling through get-rich-quick schemes. Slow and steady investing over decades wins the race.

16. Follow Your Passion

Pursue work you feel passionate about. Loving what you do will make you better, wealthier, and happier in the long run.

17. Don’t Retire, Change

Rather than ceasing work completely in retirement, change and adjust your work-life balance and purpose. Stay active.

18. Continue Learning After Retiring

Learning is a lifelong activity. After retiring from your job, dedicate time to learning new skills and topics of interest.

19. Use Money to Make a Difference

Wealth allows you to contribute to causes and make a difference. Earn with purpose, create value, and use money to change the world.

20. Give Back

Be generous with both your money and time. Contribute to charitable causes and share your wealth, knowledge, and abilities with others.

these are intangible gems! thank you!

These are intangible gems! thank you sir!